While predicting continued difficult times ahead, NAR Chief Economist Lawrence Yun and Joseph Rand, chief creative officer for Better Homes and Gardens Rand Realty, agree that the national and local housing markets entered the coronavirus pandemic in March in a strong position, and will enjoy a robust rebound as it reopens in coming weeks.

Yun and Rand were the featured speakers at a webinar entitled “Market Update and What’s Next for the Housing Market in the Pandemic Era” presented by the Hudson Gateway Association of Realtors on Wednesday, June 10.

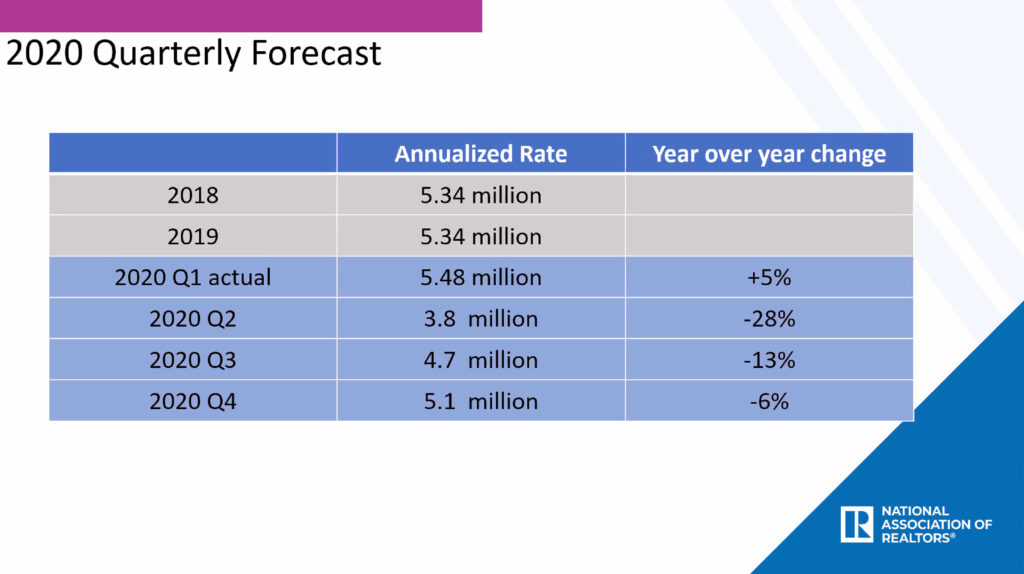

Yun noted that the national housing market, as well as the local housing market in the HGAR region, posted a very strong first quarter prior to the outbreak of COVID-19.

Noting that the Mid-Hudson region is beginning to reopen its economy, Yun related that there are a number of trends that may benefit Westchester and the Mid-Hudson going forward. In particular, he noted that New York City-based companies may realize that employees can work from home two, three days or more days a week, and therefore these workers may not have to live in Manhattan.

As more and more firms employ Zoom or other apps to conduct meetings, Yun theorized that some city residents may say, “Why don’t I own a home out in Westchester County or even out further,” knowing they don’t have to commute every single day.

Another trend that could result from the measures taken to combat the coronavirus is that people may opt for larger homes that feature space for a home office.

While noting the significant downturn that took place in the first quarter, particularly in April and May, he said there are indications that the housing market is strengthening as areas of the nation emerge from lock-down.

“I think you are in a very good position where some of the people who had been living in Manhattan may decide to move further out (to the suburbs),” Yun said. Based on those trends, he believes Westchester and the surrounding area could see an increase in buyer demand and activity.

Yun also sees what he terms as a “V-shaped recovery” in terms of home sales nationwide based on recent data, including an uptick in properties under contract.

Rand gave a comprehensive report on the regional housing market and the impacts of past events that caused economic downturns including: 9-11, Hurricane Sandy and the Financial Crisis of 2008, on home sales volume and prices.

The regional housing market has been battered by the restrictions imposed by the “New York on Pause” restrictions in March that barred in-person interactions in real estate, including showings, and only sanctioned virtual activity for residential and commercial practitioners. The regional real estate industry officially reopened earlier this week when the Mid-Hudson entered phase two of the reopening process.

Rand praised Realtors, title agencies, attorneys and the rest of the residential real estate industry for their collective efforts to keep the lights on and conduct transactions under the most trying circumstances.

“I will tell you that like a lot of other people, I have been enormously inspired and impressed by the work that the members of the association, with not just my company, but other companies and by the creativity that they brought, as well as the creativity and flexibility of the title companies who have managed to close deals with certain conditions they never have had to put on before.”

He added, “Everybody has pulled together to keep the market alive.”

Because COVID-19, unlike other economic crises in the past, involved an “operational disruption” to real estate and the general economy itself, Rand expected a much bigger hit to the local real estate market. Home sales in the HGAR region were down 27% in April and 25% in May, but due in part to a strong first quarter, home sales are currently down only 11% compared to the same period last year.

Rand, who offered seven reasons for Realtors to be optimistic about the market for the remainder of 2020, also offered a number of bullish predictions for the market, although he noted that second quarter closings will be 25%-30% lower than the same period last year.

Other predictions in his presentation, which were based on the national and regional economies continuing to stabilize included:

• June openings (new contracts) will be close to 2019 levels.

• July openings (new contracts) will hit a record.

• August closings will reach a new record.

• Third quarter closings will be close to levels posted a year earlier.

• Closings for 2020 will be down 8%-10% as compared to 2019.

If you wish to view the entire webinar, please go to: https://youtu.be/9xdEK_Fvb60.

Posted by Real Estate In-Depth