De Blasio’s property tax commission faces uphill battle in fixing lopsided system

Over the past year, the city has sought to figure out how to solve long-standing problems with the notoriously lopsided property tax system through old-school

Over the past year, the city has sought to figure out how to solve long-standing problems with the notoriously lopsided property tax system through old-school

In 2004, Assemblywoman Sandy Galef sponsored the bill to tax all of Putnam County’s state land. Now she wants a statewide solution to resolve the

The Buffalo Niagara housing market is still tight, but there are signs that the upward pressure on home prices is losing steam. Home prices still

All aspects of the architecture business are suddenly slowing, indicating an overall weakening in commercial real estate demand. A key read on the industry, the

In 2014, 19-year-old Scott Wright Jr. was shot during a Fourth of July party at the Town & Country Apartments complex on Roberts Street in

A local investment group has acquired its second cluster of apartments in Cheektowaga, spending a total of $2.8 million in the past month to buy

GENEVA — Mention the word “reassessment,” and some taxpayers will shudder. They assume it means higher property taxes. That’s not the case, Assistant City Manager

Two new reports looking at the state of real estate in the lower Hudson Valley describe a housing market that has weakened at the top

MINEOLA, N.Y. (CBSNewYork) — The massive property tax reassessment on Long Island earlier this year could force thousands of residents to pay thousands more in

The man behind the redevelopment of Seneca One tower has another major project on his hands: the overhaul of the Boulevard Mall. And he’s going

An unusually bitter, long-running debate about a $30 million housing development continues to rile a small village best known for its Main Street commercial corridor.

Co-ops and condominiums with non-union employees would have to pay them a prevailing wage in order to qualify for coveted tax abatements – if Governor

The viability of the 421-a tax abatement was up in the air last month as the New York State Senate passed sweeping reforms via a

Tax Watch columnist David McKay Wilson reviews attempts to bring equity to New York’s property tax system. The push for tax equity in Westchester and

A new style of high-end coworking space is sweeping across the country, designed to provide more than just small offices, desks and some administrative support.

MARQUETTE TOWNSHIP, Mich. (WLUC) – Marquette Township Manager, Randy Girard says since 2010, the dark store issue has cost millions and millions of dollars to

In January, hedge fund billionaire Kenneth C. Griffin closed on a $238 million deal for a penthouse at 220 Central Park South, the most expensive

CoStar Market Insights: 60% of Investment Comes from In-State Buyers, Nearly Triple the Rate in 2018 In the wake of Oregon’s new statewide law capping

Tax Watch columnist David McKay Wilson looks at how the assessment on Sandra Lee’s home can help her sell the property she calls Lily Pond.

Syracuse, N.Y. — The developer of a six-story, $25.2 million hotel and apartment building at St. Joseph’s Hospital Health Center has applied for a tax

Legislation meant to allow higher tax rates on New York golf courses looks as though it will come up short this year. Still, the lawmakers behind

CAPITAL REGION, N.Y. — Residential real estate buyers are beginning to return in full force this spring, a recent update from the Greater Capital Association

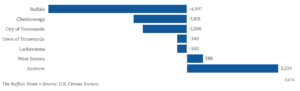

Despite the mania around downtown living and Buffalo’s urban “revival,” the city continues to lose population to its suburbs, according to new estimates from the

SKANEATELES, N.Y. – The biggest house in Onondaga County is nearing completion. After three years of construction on the western shore of Skaneateles Lake, builders

SALT LAKE CITY — For millennials looking to buy their first home, the hunt feels like a race against the clock. In the seven years

SOMERS — A decision to table legislation on the “dark stores” loophole Wednesday in Madison was not received kindly by some in the state capital

MAHOPAC, N.Y. – It’s tax time again and town officials want to make sure you have the proper information on how your property was assessed

ALBANY – Tax assessors across New York are ripping a new state law that will mean homeowners earning between $250,000 and $500,000 a year will

Median sale price in April rose 6.3% to $144,501 $160,000 2019 $144.501 $140,000 $120,000 $100,000 $80,000 $60,000 $40,000 $20,000 $0 1999 2002 2005 2008 2011

Among suburban voters and lawmakers, the STAR school tax exemption is an endless topic of discussion since over the years there have been a number