Co-op and Condo Tax Abatements Could Be Tied to Staff Pay

Co-ops and condominiums with non-union employees would have to pay them a prevailing wage in order to qualify for coveted tax abatements – if Governor

Co-ops and condominiums with non-union employees would have to pay them a prevailing wage in order to qualify for coveted tax abatements – if Governor

The viability of the 421-a tax abatement was up in the air last month as the New York State Senate passed sweeping reforms via a

Tax Watch columnist David McKay Wilson reviews attempts to bring equity to New York’s property tax system. The push for tax equity in Westchester and

A new style of high-end coworking space is sweeping across the country, designed to provide more than just small offices, desks and some administrative support.

MARQUETTE TOWNSHIP, Mich. (WLUC) – Marquette Township Manager, Randy Girard says since 2010, the dark store issue has cost millions and millions of dollars to

In January, hedge fund billionaire Kenneth C. Griffin closed on a $238 million deal for a penthouse at 220 Central Park South, the most expensive

CoStar Market Insights: 60% of Investment Comes from In-State Buyers, Nearly Triple the Rate in 2018 In the wake of Oregon’s new statewide law capping

Tax Watch columnist David McKay Wilson looks at how the assessment on Sandra Lee’s home can help her sell the property she calls Lily Pond.

Syracuse, N.Y. — The developer of a six-story, $25.2 million hotel and apartment building at St. Joseph’s Hospital Health Center has applied for a tax

Legislation meant to allow higher tax rates on New York golf courses looks as though it will come up short this year. Still, the lawmakers behind

CAPITAL REGION, N.Y. — Residential real estate buyers are beginning to return in full force this spring, a recent update from the Greater Capital Association

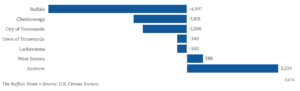

Despite the mania around downtown living and Buffalo’s urban “revival,” the city continues to lose population to its suburbs, according to new estimates from the