The Buffalo Niagara housing market is showing signs of resiliency, even with the limitations that made it harder to buy and sell homes for most of this spring.

Despite fears that the housing market would collapse as the recession took hold, prices still rose in May and homes continued to sell quickly.

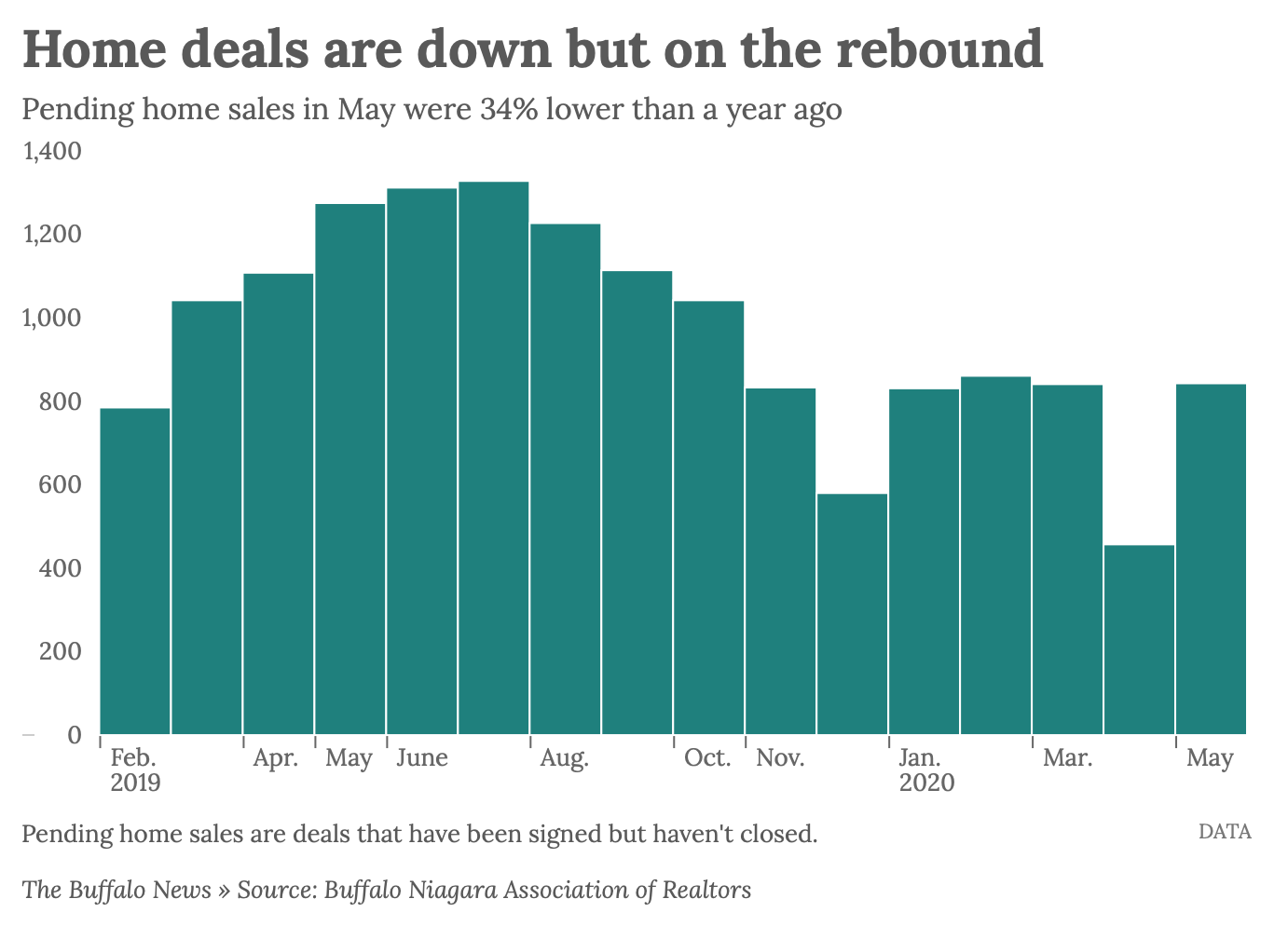

While local sales are down by a third from a year ago, May was still much stronger than April – when the lockdown was in full force, and both consumers and businesses were facing uncertainty over how long and how deeply the pandemic would hurt the region’s economy.

And now that the economy is more fully reopening, realtors say the market is hopping.

“The market has just been flying all week,” said Jerry Thompson, owner of Century 21 Gold Standard in East Aurora.

The most recent housing data from the Buffalo Niagara Association of Realtors, released last week, show that the housing market rebounded strongly last month from its April lows, and that buyers are continuing to buy.

In the longer term, the recession ultimately could weaken the housing market if unemployment, now at record highs, continues to be elevated, diminishing the pool of potential buyers as their incomes take a hit from layoffs and pay cuts, local economists have warned. A more normal gush of new home listings also could start to shift the balance of power in the housing market away from sellers as choices become more plentiful.

But that’s not happening now, with the market being buoyed by pent-up demand among buyers.

Brokers say the market is showing particular strength with more expensive homes. Despite the plunge in sales, median prices hit monthly records during both April and May, rising by more than 10% combined.

In fact, says Greg Straus, co-owner of 716 Realty Group, “we are experiencing an overload of buyers.”

“I am experiencing a level of demand from buyers higher than I’ve ever seen before,” said Jonathan M. Carvallo, a real estate agent with Keller Williams Buffalo.

That’s great from one side of the coin. What’s still holding the market back – and also one major reason for the resiliency – is the continued shortage of homes for sale, whose supply is at its lowest level in at least 22 years.

“We are probably at a point now where inventory is just painfully low,” Thompson said. “We need more houses to sell.”

The local housing market was off to a strong start in 2020 before the pandemic pushed the economy into recession. Deals to buy homes were running about 10% above last year’s pace through February, while median sale prices continued to rise.

The market slowed to a crawl when the Covid-19 lockdown took hold in late March. Showings were limited to vacant homes, in most cases.

The economic uncertainty as layoffs spread throughout the economy weighed on buyers as concerns grew about their job security and the duration of the downturn. Deals to buy homes plummeted by 60% in April to the lowest for any single month in the last 5 1/2 years.

But as the economy started to reopen in May, buyers started looking at homes in greater numbers. While the home buying season typically begins in earnest during March and April, the number of deals that were signed last month was roughly on par with the monthly activity during each of the first three months of this year.

“There’s significant buyer demand,” Thompson said. “The interest rates are phenomenal. People are feeling good again. It’s sunny. They’re able to leave their houses again. They’re taking action and they’re buying houses quickly.”

The difference was even more pronounced on the seller side. Only a little more than 1,600 homes were listed for sale during April and May combined. During a typical May, around 1,800 houses usually go up for sale, so the choices that buyers have remain severely limited and are helping to keep sales brisk. The average home that is for sale is selling in just 39 days, almost a full week faster than last May.

As a result, the housing market remains firmly tilted in favor of sellers, despite the economic upheaval. While most recessions typically have the type of sales slowdown that occurred over the past three months, it usually is accompanied by a comparable rise in the number of homes for sale as the homes that come onto the market linger for longer.

That’s not happening this time. Homes are still selling fast, and the supply of homes for sale is only enough to cover about two months of sales at the current pace. A market where buyers and sellers are in balance typically has about a six-month supply of homes for sale, and that hasn’t changed even during the pandemic.

“There’s been a bit of a frenzy for the houses that are priced right and presented right,” Thompson said.

That inventory crunch is helping to prop up home prices, even as real estate agents grapple with restrictions on how they could show houses and buyers faced their own economic uncertainty, as the pandemic pushed nearly one of every four local workers out of their jobs, at least temporarily.

“Buyers have been quicker to return to the housing market in force than sellers, who have been showing a bit more reluctance to list their homes than is typical for this time of year,” the real estate group said in its analysis of the May housing data.

Published in The Buffalo News