Housing market conditions improved in May, according to REALTORS® who responded to NAR’s May 2020 Realtors® Confidence Index (RCI) Survey, a survey of REALTORS® about their monthly transactions. Transaction indicators pertaining to buyer offers, client tours, and listings all picked up in May.

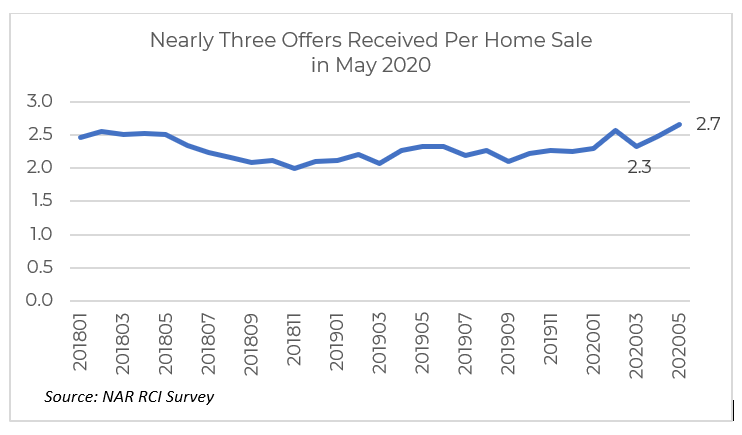

On average, there were about three offers on a home that closed in May, up from just about two in April 2020 and in May 2019 (2.3 offers).

The median number of in-person home tours rose to two clients in May, up from 1 client in April 2020. Forty-five percent of respondents also reported conducting virtual tours/showings. However, the median number of client tours still has to recover to pre-coronavirus levels of about 3 to 4 client tours per month per agent.

On average, respondents listed on average 1.3 homes, up from 1.1 homes in April. Recall that REALTORS® took out about four clients on a physical home tour. However, the average number of listings per month per listing agent is still way below pre-coronavirus level of nearly two listings (1.5) in May 2019.

43% of Realtors® Expect Stronger Buyer Traffic in the Next 3 Months

Given the positive direction of the housing market, 43% of respondents expect stronger homebuyer traffic in the next three months compared to the same period last year, up from only 25% who expected stronger buyer traffic in the April survey. Only 21% expect weaker buyer traffic compared to one year ago over the next three months, a decrease from the 40% share in the April survey.

In all states except for Hawaii, REALTORS® expect home prices to remain stable or increase in the next three months, with demand outstripping the supply of homes that are on the market.

Low Mortgage Rates and Job Creation Buoying Up Home Sales

Low mortgage rates and job creation in May are buoying homebuying and expectations. The 30-year fixed contract rate dropped to a historic low of 3.15% during the week ended June 11, according to Freddie Mac’s survey. Mortgage applications for home purchases have been trending up since April 17, with applications up 25% on a year-over-year basis as of June 12, based on Mortgage Bankers Association data. Mortgage rates are expected to remain low until 2022, with Fed Chairman Powell stating on June 10 after the FOMC Meeting that that ‘they are not even thinking about raising rates until 2022.”1

Homeowning is now cheaper than renting. I estimate the median gross rent for vacant units in April 2020 at $1,0772. This is higher than the mortgage payment of $1,020 on a home purchased at the median sales price of $286,800, with a 20% down payment on a 30-year loan with a fixed mortgage rate of 3.37%.

In May, the number of employed rose to 3.8 million, based on the BLS Household Survey. This includes both self-employed and payroll workers, which is more than the 2.5 million net new payroll jobs from the Establishment survey3.

In May, the number of employed rose to 3.8 million, based on the BLS Household Survey. This includes both self-employed and payroll workers, which is more than the 2.5 million net new payroll jobs from the Establishment survey3.

While the number of workers receiving unemployment insurance benefit remains elevated at 20.5 million, there were 4.5 million fewer workers who received unemployment insurance (UI) benefits compared to 24.9 million on May 9. This indicates these workers may have found new jobs or returned to their job (including those who recovered from an illness or ended caring for a family member with COVID-19).

There was a decline in the number of workers receiving unemployment insurance in 41 states as of the week of June 6 compared to the number of beneficiaries in the prior week (not seasonally adjusted basis). Only nine states and the District of Columbia had an increase in workers who received unemployment insurance, led by California (+184,084), Texas (+83,544), Pennsylvania (+64,197), Oklahoma (+17,163) which had an increase of more than 10,000 people. Other states in which the number of workers receiving unemployment insurance benefits rose were Maryland, Massachusetts, Mississippi, and Connecticut.

About the Realtors® Confidence Index Survey

The April 2020 survey was sent to 50,000 REALTORS® who were selected from NAR’s more than 1.4 million members through simple random sampling and to 9,070 respondents in the previous three surveys who provided their email addresses. There were 4,232 respondents to the online survey which ran from June 1-10, 2020, of which 1,749 had a client. Among those who had a client, the survey’s maximum margin of error for proportion estimates is two percent at the 95 percent confidence level. The margins of error for subgroups are larger. NAR weights the responses by a factor that aligns the sample distribution of responses to the distribution of NAR membership. For information about this survey, email data@nar.realtor(link sends e-mail).

Published by National Association of Realtors