SYRACUSE, N.Y. — Property assessments in Syracuse are outdated and favor the rich over the poor. But other cities in New York are worse.

Outdated assessments in Syracuse and other municipalities often mean that homeowners in the poorest neighborhoods shoulder too much of the tax burden compared with their counterparts in rich or middle-class areas.

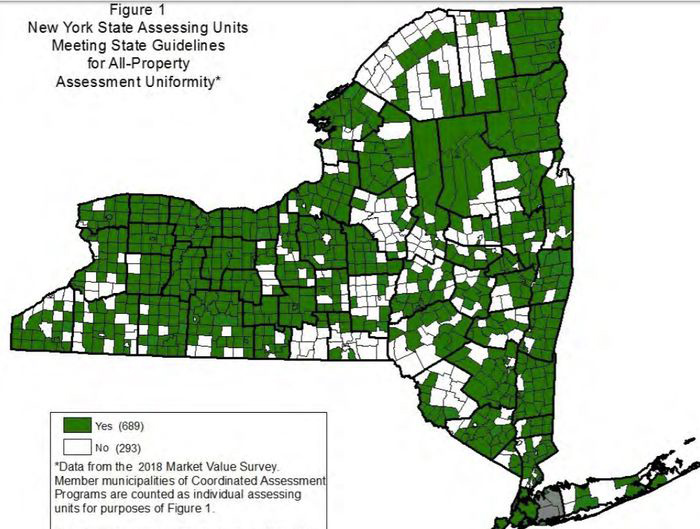

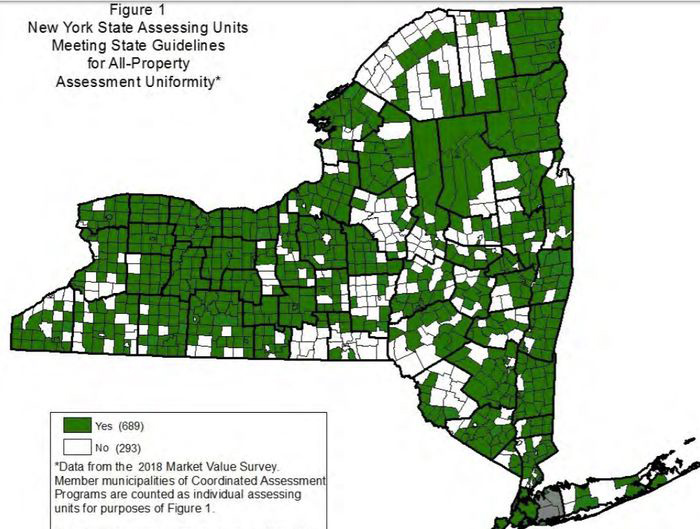

New York state measures that problem with statistics but does not pressure local assessors to fix it. Unlike most states, New York cedes control over assessments to roughly 1,000 cities, towns and villages.

The result is a complex, erratic mess, according to one expert.

“New York is all over the place,’’ said John Yinger, professor of public administration and economics at Syracuse University’s Maxwell School of Citizenship and Public Affairs. “It has one of the craziest systems in the country.’’

Syracuse’s unfair property tax system hurts poor the most; here’s what can be done (exclusive):

Some of the city’s wealthiest homeowners pay hundreds of dollars a year less than they should, year after year. It’s a hidden tax break for high-end homeowners.

New York is one of only five states that do not compel municipalities to redo property assessments on a fixed schedule, according to the Lincoln Institute of Land Policy. Eighteen states require revaluation every year. Others typically require it within three to five years.

Syracuse has not reassessed in 23 years. The town of Clay last reassessed more than 60 years ago.

The state tax department provides technical assistance and software to municipalities. The state also provides small amounts of aid to motivate municipalities to reassess annually. But it’s up to the locals how often to assess.

More than 40 percent of New York municipalities fail to meet professional standards for equitable assessment of residential properties, according to statistics published by the state tax department.

In Onondaga County, only Syracuse and Otisco fall short. There are no penalties. New York takes a hands-off approach.

“We’re a local home rule state, so a lot of these issues probably to (state tax officials) seem very local,’’ said Assembly Member Sandy Galef, who chairs the property tax committee. “I would say they’re not assertive at all.’’

Galef, D-Ossining, is sponsoring legislation that would require municipalities to conduct a full reassessment at least every four years.

Although Syracuse has not conducted a full reassessment since 1996, city officials adjust some assessments each year in neighborhoods where market prices are rising faster than average, or where they are falling.

David Clifford, the commissioner of assessment, said that’s one reason why Syracuse assessments are statistically less biased than in other cities.

New York state evaluates municipalities using two standards of assessment equity set by the International Association of Assessing Officers.

One statistic, called the coefficient of dispersion, measures variation between assessments. A score of 15 or below is considered acceptable. Syracuse has slightly exceeded that level in all but one of the past 12 years, with scores ranging from 14.74 to 16.88.

Other cities make Syracuse look good. Binghamton scored 23.41 last year. Utica scored 25.6.

Another statistic, the price-related differential, shows whether assessments are biased in favor of high-value property owners. Any score between .98 and 1.03 is considered unbiased. Syracuse typically scores between 1.04 and 1.06, indicating that assessments tend to be too low for the most expensive properties.

Other cities are worse. Buffalo, Binghamton and Utica all scored 1.11 last year.

Here’s what state tax officials say property owners can do if they think assessments are unbalanced: Demand a comprehensive revaluation.

“Property owners with systemic concerns regarding local assessment levels should encourage their local government to do a revaluation,’’ said James Gazzale, of the state tax department.

Read the full article on Syracuse News’ website.