Home sales took a deep dive in March as the coronavirus pandemic shut down much of the economy and homebuyers and sellers pulled out of the normally busy spring market.

Signed contracts to purchase existing homes, referred to as pending home sales, fell 20.8% compared with February and were 16.3% lower annually, according to the National Association of Realtors.

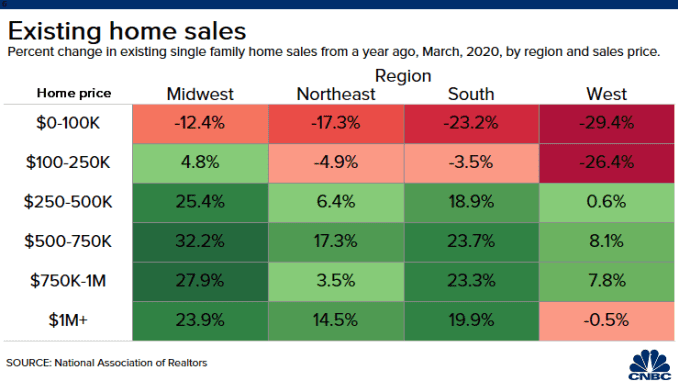

Regionally, pending sales fell 14.5% in the Northeast for the month and were 11% lower than a year ago. In the Midwest, sales decreased 22% monthly and 12.4% annually. In the South sales dropped 19.5% for the week and 17.8% annually, and in the West they fell 26.8% weekly and 21.5% compared with a year ago.

The existing home market had already been suffering from a severe shortage of properties for sale, and that supply hit a record low in March. Not only did potential sellers decide against listing their homes in the current economic environment, but some sellers already on the market delisted their properties.

“The housing market is temporarily grappling with the coronavirus-induced shutdown, which pulled down new listings and new contracts,” said Lawrence Yun, NAR’s chief economist. “As consumers become more accustomed to social distancing protocols, and with the economy slowly and safely reopening, listings and buying activity will resume, especially given the record low mortgage rates.”

The average rate on the 30-year fixed mortgage fell to a new low of 3.43% last week, according to the Mortgage Bankers Association. Mortgages are definitely cheaper, but it is also harder to get one. Lenders have tightened their underwriting standards, and some have increased minimum credit scores. The government’s mortgage forbearance program, allowing troubled borrowers to delay monthly payments, has added risk to the overall market.

While the numbers for March are grim, a turnaround may have already started. Mortgage applications to purchase a home, after falling dramatically for five weeks, suddenly moved higher last week, rising 12% compared with the previous week, according to the MBA. Those applications were still 20% lower annually, but even that annual comparison was a vast improvement over the previous week.

“The 10 largest states [by normal application volume] had increases in purchase activity, which is potentially a sign of the start of an upturn in the pandemic-delayed spring homebuying season, as coronavirus lockdown restrictions slowly ease in various markets,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

The spring season will still be anemic, though, and even potential pent-up demand released in the fall will not be able to make up for the losses. Yun is now predicting total home sales for 2020 will be 14% lower annually. He does not, however, predict big losses for home values.

“In fact, due to the ongoing housing shortage, home prices are likely to squeeze out a gain in 2020 to a new record high,” he added, projecting that the national median home price will increase 1.3% for the year, with some local market variations and more weakness on the upper end of the market.

Posted by CNBC