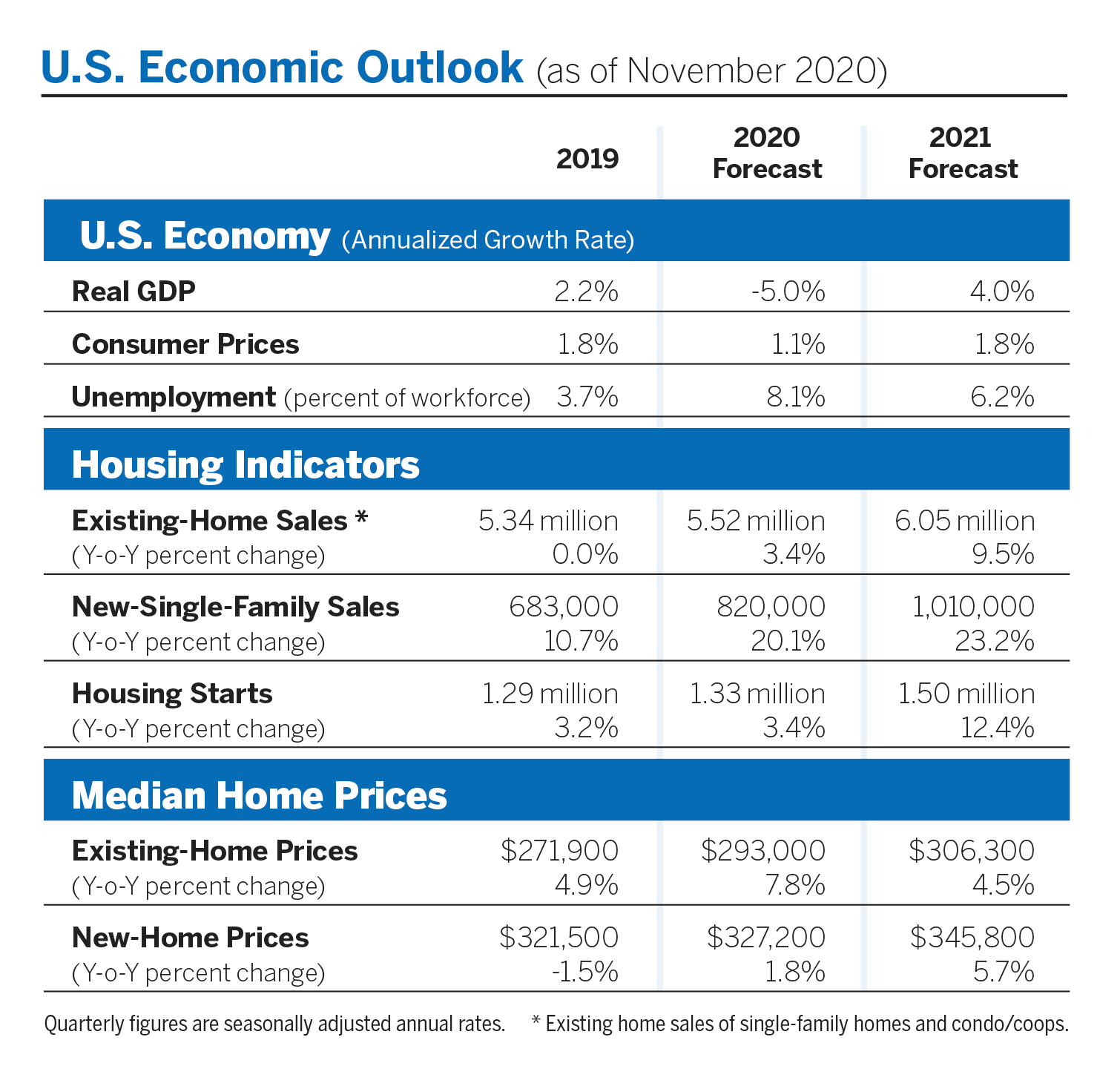

The housing market was a spectacular surprise in 2020—and the positive trend will continue this year. Home sales in 2021 are expected to rise by around 10%. Home prices will also climb, but I expect more moderate increases than we’ve seen, a break for first-time buyers. Mortgage rates will continue to be favorable, staying at or near historic lows of 3% on average. The labor market will strengthen, especially as vaccines become widely available and life moves toward normal.

Around 4 million net jobs could be added, a gradual rebound from the net loss of roughly 7 million during the pandemic year of 2020. The unemployment rate by the year’s end could be at 5.5%, a great improvement from 14.7% in April 2020 when the nation was under a strict lockdown, but still a few notches up from the generational low of 3.5% right before the pandemic.

Low mortgage rates have been the key reason for the housing market’s strong performance in the midst of the pandemic and high unemployment. Time and again, home sales have responded to rate changes. In 2018, the economy was roaring along with jobs, jobs, and jobs, but interest rates climbed as high as 4.9% and home sales went into reverse. The annualized sales pace fell from 5.5 million at the beginning of the year to 5 million by year’s end. Taking another illustration, home sales were at the 5.2 million pace in September 2001 but then rose to an annualized pace of 6 million by the end of 2002, even though the economy underwent a recession with job losses after the horror of 9/11. The faster pace of sales came because, over that period, mortgage rates fell from 7% to 6%.

While mortgage rates are highly influential, they’re not the only factor affecting home sales. Given the substantial commitment and financial dollars at stake, consumer confidence and life-cycle events such as marriage, changes to family size, and retirement all play a role. During the pandemic, we learned that most people who work in offices could be just as productive at home, and this new reality will help fuel home sales in the post-pandemic economy. Already, big tech companies are allowing greater work-from-home flexibility. Other organizations will no doubt follow in some hybrid fashion. Perhaps the work-from-home trend was inevitable as internet speed and software improved. The pandemic just accelerated the timeline in a flash.

Owners who were content with their home before the pandemic are thinking about the benefits of another bedroom to use as a dedicated home office or are considering relocating to the countryside, knowing that commuting to downtown offices every day has become a thing of the past. Some consumers are turning to vacation properties as an appealing work-from-home option. The evidence is in the data showing home sales in vacation destinations around Lake Tahoe, the Smoky Mountains, and the Atlantic Coast growing faster than in metropolitan markets.

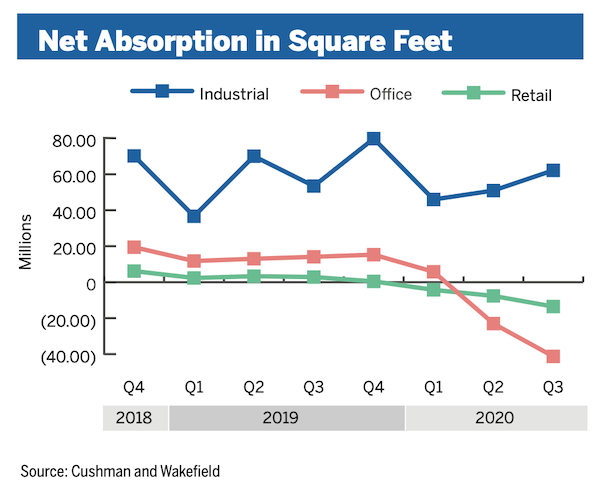

The encouraging news on the home front contrasts drastically with the specter of nearly empty office buildings. Those with leases are still mostly paying rent even though office spaces are not being used, and businesses with leases that are terminating are clearly reevaluating their space needs. In the second and third quarter of 2020, office usage dropped by a combined 74 million square feet. The situation will not improve until the middle of this year; even then, the normal relationship between office job creation and net new leasing will not align as many companies will reevaluate and rejigger their office space needs. Downtown retail shops and eateries will also undergo a harsh transition from the reduced foot traffic.

Commercial, industrial, and warehouse demand, meanwhile, are doing great. Net absorption, meaning the total space that became occupied minus the total that became vacant in a given time period, rose by 113 million square feet in the second and third quarters of last year. While people are increasingly avoiding in-person shopping, e-commerce, already rising before the pandemic, made a hockey-stick upturn during this time. Even after vaccines arrive and people feel safer about going out, there is likely to be significant overcapacity of shopping malls.

That’s why reuse and adaptation will be important. Successful shopping mall transformations result in mixed-use properties, allowing for residential, office, and retail spaces and medical clinics. Other possibilities include online shopping fulfillment centers, sports facilities including gyms, self-storage areas, and even health care armories (to prepare for the next pandemic).

Multifamily apartments are holding on reasonably well considering the pandemic’s effect on both occupancy levels and rent collection. The housing shortage is the result of a decade of underproduction of all housing types. That is why apartment vacancy rates have been rising only by decimal points during this recession. Renters who would like to transition into ownership are facing sticker shock at home prices. Even with record low mortgage rates, affordability is barely improving because costs are outpacing income. Nothing is as demoralizing as saving up for a down payment and continuing to find you never have enough because of fast-rising home prices.

Help could be on the way. President-elect Joe Biden has proposed a $15,000 first-time home buyer tax credit, which would be available at the closing table. In essence, it is down payment assistance. Some negotiation with Congress is needed to make it into a law, and surely there will be qualifying income limitations to ensure the benefit goes to those who need it most. This is certainly welcome news for many renters. But it is insufficient.

The housing market is facing an acute inventory shortage. Adding more demand without addressing the supply will push up home prices at an even faster clip. That is why it’s critical to turn raw land into developable lots so that homebuilders can increase production. But Biden’s proposal to remove 1031 like-kind exchanges from the tax code would hinder land sales and pile more negative pressure onto commercial real estate. Without serious reconsideration of the value of this tax incentive, home prices could take off and essentially negate the benefit of federally supported down payment assistance programs.

The Biden administration is also likely to appoint Federal Reserve governors who will be more tolerant of higher inflation in order to quickly bring down the unemployment rate. That means printing more money. Don’t be surprised if, over time, prices for a tangible asset like real estate consistently outpace overall consumer price inflation. Even bitcoin, with its limited supply, may attract investors.

Finally, under a Biden presidency, overall government spending is likely to rise. The goal: Fix the economy before worrying about the deficit. Spending on programs such as high-speed internet access for rural communities and improved rail transportation to distant suburbs will have a positive impact, since demand will continue to increase outside of city centers. Land is plentiful and relatively cheap, making it easier for homebuilders to construct homes. Only when the supply of new homes is growing does stimulating additional demand make sense.

Published by Realtor Magazine