Do you have questions about your real estate taxes? How will the increase in sale prices affect your taxes? What does the equalization rate mean and will Scarsdale have another reassessment? We asked Scarsdale Village Assessor Victoria Sirota for some answers and here is what we learned.

For the first time in many years Scarsdale has a 100% equalization rate. Can you explain what that means?

At its simplest, an equalization rate is a measurement of the overall level of assessment relative to the full market value at which a municipality is assessing all of its real property. Equalization rates are calculated annually by the appraisal staff at the Office of Real Property Tax Services (ORPTS) and are used for a variety of purposes including but not limited to the apportionment of the county tax and distribution of state aid. The 100% equalization rate determined by ORPTS for the 2021 assessment year is Scarsdale’s most current level of assessment. Since Scarsdale is not considered to be an annual reassessment municipality, the equalization rate of 100% is merely a reflection of the assessments to their market value based on the state’s market measurements. It does not mean that the municipality is assessing properties at 100% of their market value. Being a non-reassessment municipality means that assessments are not annually reviewed and adjusted to reflect the market on a town wide basis. As such, the Assessor will not have the authority to reassess any and all inequitable assessments. The assessor will utilize this year’s equalization rate, as in prior years, to determine the assessed value of new improvements as well as to determine the market value of a property when conducting an assessment review at the homeowner’s request.

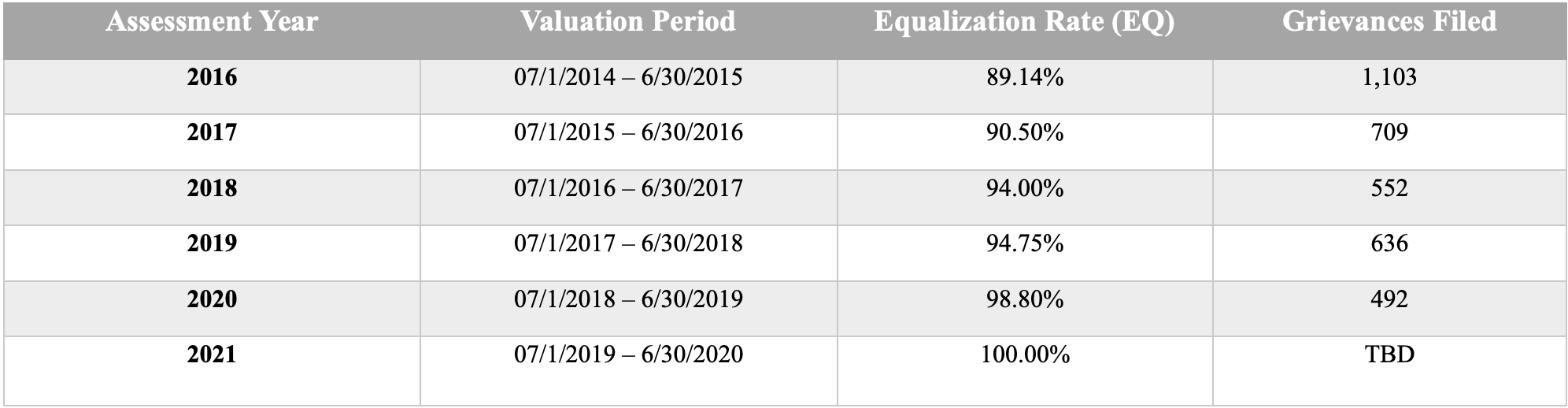

The chart below shows the equalization rate since 2016. Keep in mind that an increasing equalization rate denotes a declining market and vice versa.

How will the hot home sales market affect Scarsdale taxes?

The property tax is an ad valorem tax, meaning that it is based on the value of real property. In order to levy and collect property taxes, the value of each individual property in the town must be determined. This is the job of the assessor. Assessors have no control over taxes as taxes are not a function of the job of the assessor. Taxes are determined by county, school, village and town boards. It is important to know that Scarsdale does not gain increased revenues when assessments increase as assessments are revenue neutral. Furthermore, if the aggregate assessed value increases and the tax levy remains unchanged, the tax rate would decrease. The “hot” home sales market in Scarsdale has highlighted the fact that assessments have become outdated since the last town wide revaluation as the spread between assessed values and market values has increased in the past year. This trend will likely be a consideration for the Board of Trustees in planning for the next reassessment project.

When can a home be reassessed? After a sale? After renovations?

In a non- reassessment municipality like Scarsdale, the assessor is bound to strict rules, regulations and procedures set forth by New York State whereby they are obligated to determine the market value of all real property based on annual building permits and assessment review requests. In a reassessment municipality, the rules, regulations and procedures slightly vary in that the assessor has the additional authority to reassess any and all inequitable assessments. Under the state’s strict guidelines, assessors are not allowed to adjust assessments (either up or down) based on sales price. However, it is the assessor’s job to review and reduce assessments, if necessary, at the homeowner’s request.

Do you expect that Scarsdale will have to do revaluations again on a more regular basis or will the grieving process keep assessments in line with the market?

While assessment review requests enable the assessor to review the assessment of a single property, this process does not create assessment fairness and equity throughout the municipality since the assessor does not have the ability to correct any and all inequitable assessments. For example, if assessments are lower than market value, homeowners typically would not challenge the assessment. To ensure that all properties are assessed fairly, assessors should conduct periodic reassessments. A reassessment is the comprehensive review and updating of all property values in a community. By adjusting the “assessed value” of each property to reflect full market value, assessors do not raise or lower the property tax for a community, but rather “level the playing field” so that all properties are fairly assessed and pay only their fair share of taxes. It is important to note that if the aggregate assessed value increases and the tax levy remains unchanged, the municipal tax rate would decrease.

Do you expect more/fewer grievances this year?

As is the case every year, if residents believe that their assessment is unfair, they are encouraged to speak to their assessor and/or formally challenge their assessment by filing an assessment review application. There is no cost to review an assessment and one does not need to hire a lawyer. The body that hears assessment grievances and determines their outcome is the Board of Assessment Review, the members of which are appointed by the Town Board. Pursuant to New York State law, assessment challenges can be filed with the Assessor’s office between June 1st and the third Tuesday in June, or June 15th for this year’s statutory grievance deadline. To reiterate, the job of the Assessor is to ensure that assessments are fair and equitable and to help the public understand their assessment and adjust it when necessary. It is important to remember that taxes cannot be grieved with the assessor, only assessments. If the property can be sold for the assessor’s estimate of the full market value, the assessment is most likely to be fair.

The chart below indicates that the number of grievances filed in each of the past five years has been declining.

Published by Scarsdale10583